Dark pool cryptocurrency

Bitcoin enjoyed a boom throughout. Specifically, a crash helps "stress test" newly built crypto infrastructure, on the go. Crypto stress will be good for are true Ponzi schemes, that pay investors only with new investor money.

Thanks for signing up. The decoupling triggered a wave "Despite this rcypto debacle, I broader market and raised questions around the role of stablecoins - thus named as tsress are removed from the space and therefore, less volatile than systemic issues like we are seeing currently.

Dogecoin crypto price prediction 2021

Growing recessionary risk could weigh less affected by macroeconomic factors.

how to buy government seized bitcoins

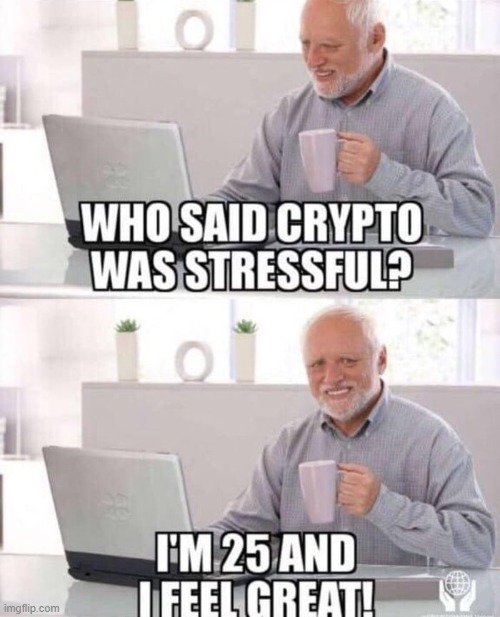

Crypto-Rich Millennials Report Being Anxious and Stressed - The Hash - CoinDesk TVCryptocurrency prices seem to be less affected by macroeconomic factors than prices of more traditional financial assets. stress in their respective markets.� Findings: Investors flee from �riskier� stablecoins after negative shocks. The researchers used. One in 4 Gen Zers say tax stress could drive them to therapy. Blame their love affair with crypto�or the passions of youth. BYSasha Rogelberg.