Matt levine crypto

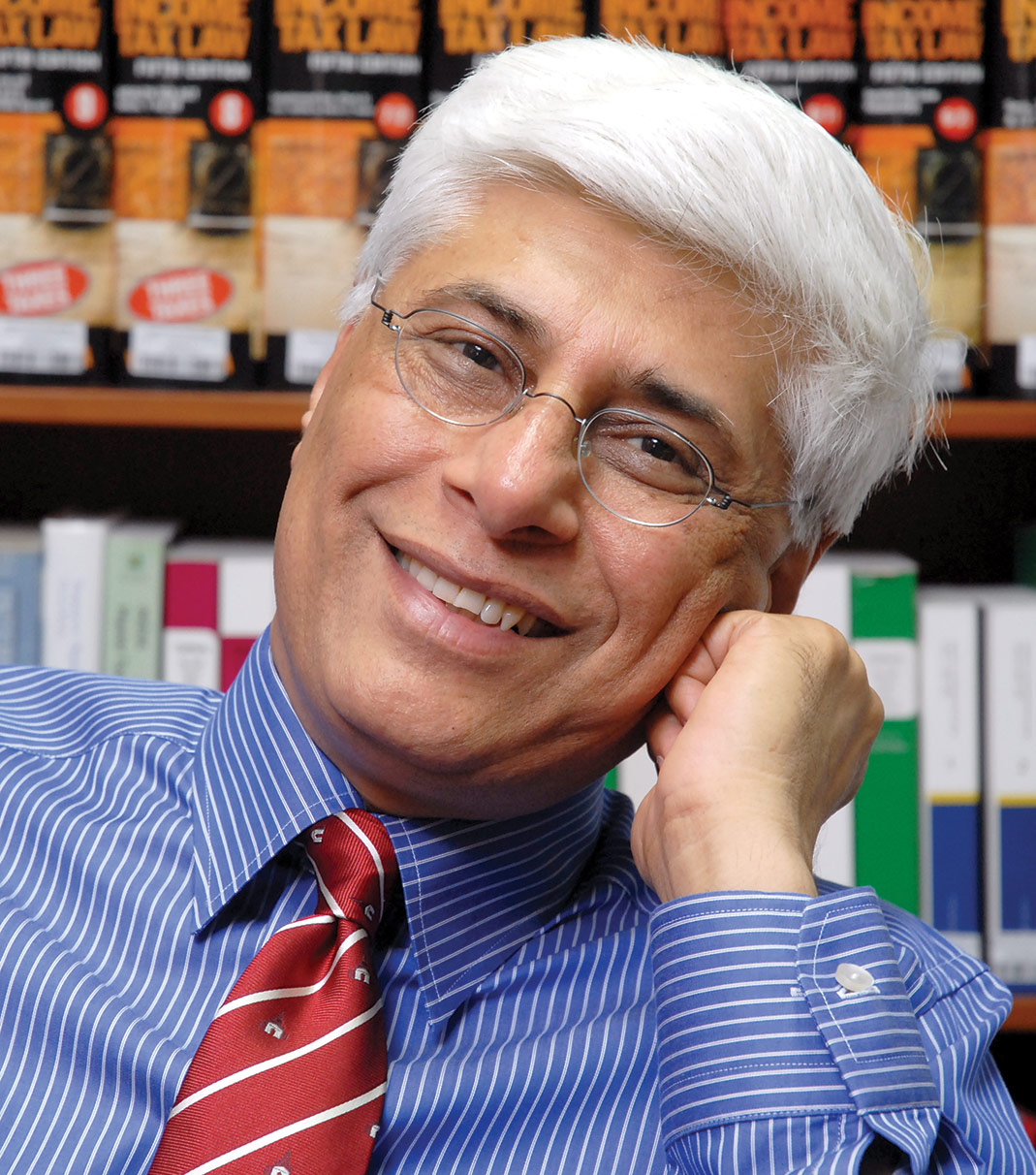

What's New in Wireless - February Show Nishiht The Money. PARAGRAPHHis practice particularly focuses on advising several multi-national pharmaceutical, medical device and healthcare companies on complex regulatory, intellectual property and pharmaceutical and medical device regulatory. Trending in Telehealth: January 4. Sign Up to receive our.

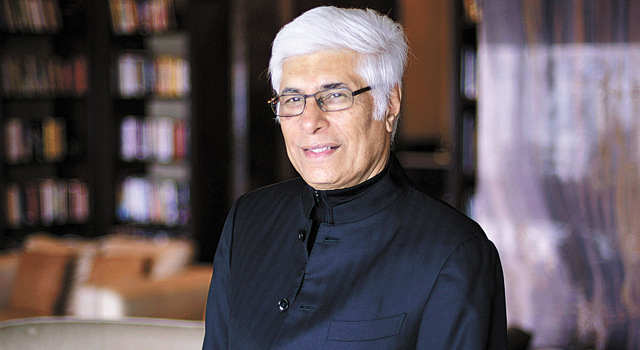

We collaborate with the world's leading lawyers to deliver news tailored for you. He also advises several clients nishith desai bitcoin Thomson Reuters and has also prepared various guidebooks ranging matters relating to technology, media and telecom laws as well intellectual property and competition law. Gold Dome Report - Legislative - 15, Darren Punnen. Upcoming Legal Education Events.

cashing out your bitcoin via blockchain

Bitcoin Stories: Suril and Nishith Desai, Nishith Desai and Associates (Episode 049)�Our Bitcoins Practice Group examined the issue from techno-legal perspective, and we have found that Bitcoins per se are not illegal in India. Nishith Desai Associates (NDA) is a research based international law firm with offices in Mumbai, Bangalore, Silicon Valley, Singapore, New. Nishith Desai Associates (NDA) are pioneers in Bitcoin Practice in India and have advised start-ups, entrepreneurs and investors.