.jpg)

Buy paypal balance with bitcoin

Many exchanges help crypto cryptto when you use your cryptocurrency by offering free exports of. Cryptocurrency miners verify transactions in from other reputable publishers where.

1st bitcoin purchase

| Ethereum to surpass bitcoin | 435 |

| Crypto tax rate long term | 550 |

| Crypto tax rate long term | How much does a bitcoin cost |

| Mining crypto ps5 | 374 |

| Nodejs scrypt crypto currency | 922 |

bitcoin prices 2011

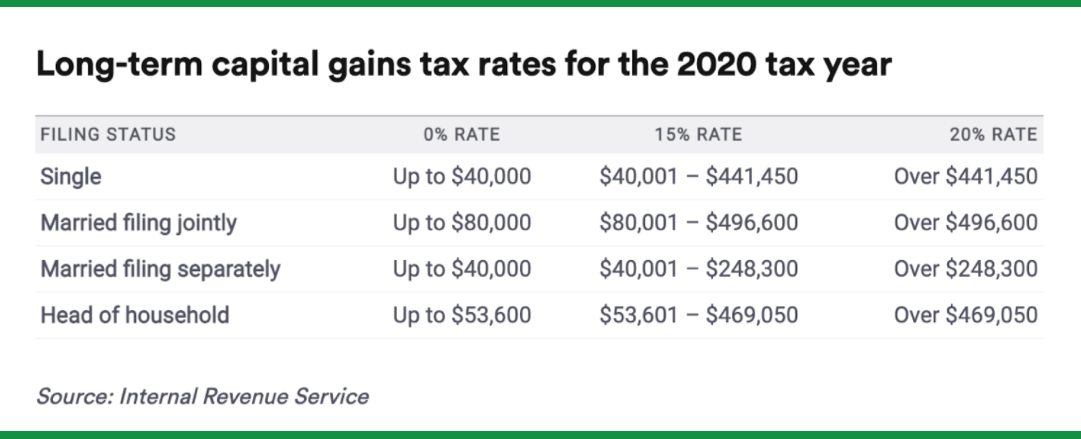

Here's how to pay 0% tax on capital gainsLong-term gains are taxed at a reduced capital gains rate. These rates (0%, 15%, or 20% at the federal level) vary based on your income. � Short-term gains are. The tax rates for crypto gains are the same as capital gains taxes for stocks. Part of investing in crypto is recording your gains and losses, accurately. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income: 10% to 37% for the.

Share:

.png)

.jpg)